- Get link

- Other Apps

- Get link

- Other Apps

The concept of money laundering is essential to be understood for these working in the monetary sector. It's a process by which dirty money is transformed into clean cash. The sources of the money in precise are legal and the money is invested in a manner that makes it appear to be clear cash and conceal the identity of the legal a part of the money earned.

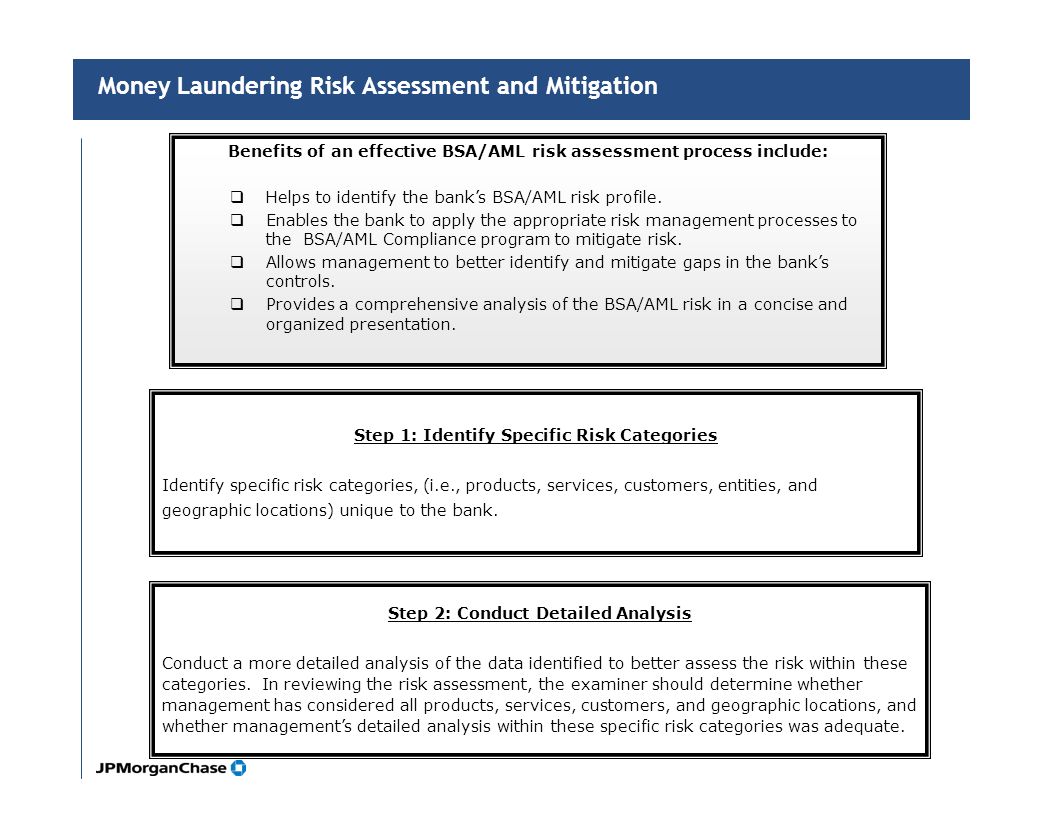

While executing the financial transactions and establishing relationship with the brand new prospects or sustaining present prospects the responsibility of adopting sufficient measures lie on every one who is part of the group. The identification of such element to start with is straightforward to deal with instead realizing and encountering such conditions in a while in the transaction stage. The central bank in any country provides complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide enough security to the banks to discourage such situations.

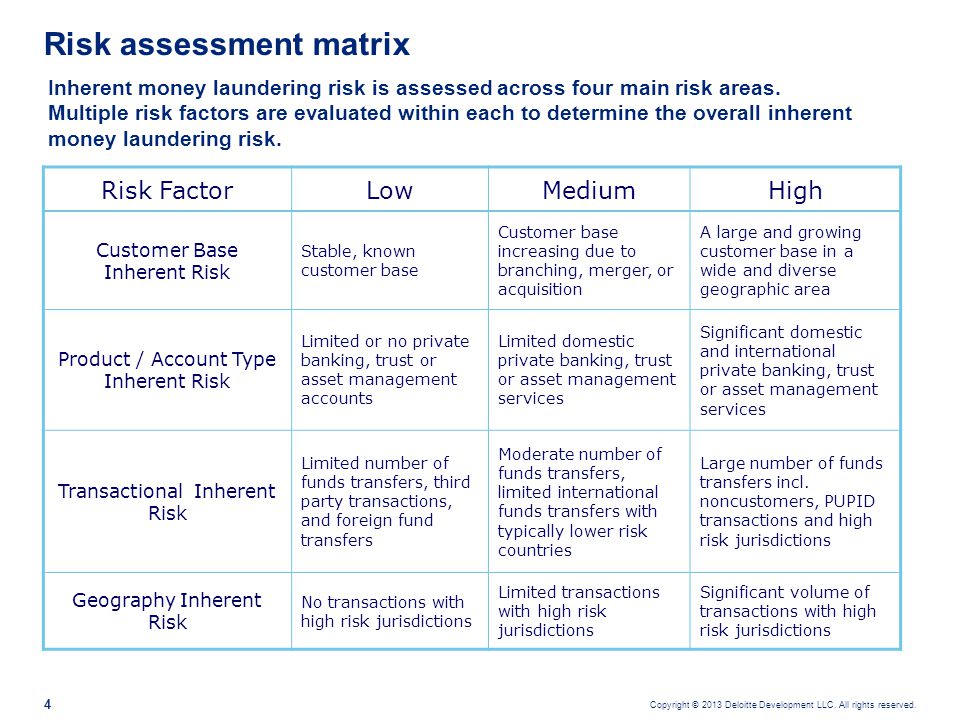

Laundering and terrorist financing risks for customers countries or geographic areas products services and transactions or delivery channels. The number of geographic risk indicators cited by regulators and other governmental bodies have increased significantly over the years and are subject to change.

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

The issue of risk of money laundering in the European banking system was presented in the article.

Money laundering geographic risk. Those seeking to undertake money laundering and the financing of terrorism can form offshore business entities to allow transactions to appear business related. The vulnerability to money laundering threats that countries face at a national level. INTRODUCTION TERMINOLOGY 11 Purpose scope and status of this guidance 1.

This update takes into account changes to the EU Anti Money Laundering and Counter Terrorism Financing AMLCFT legal framework and new MLTF risks including those identified by the EBAs. Because DeFi protocols are permissionless by design they often lack any clear regulatory compliance. Geographic risk is important for both the property and the buyer.

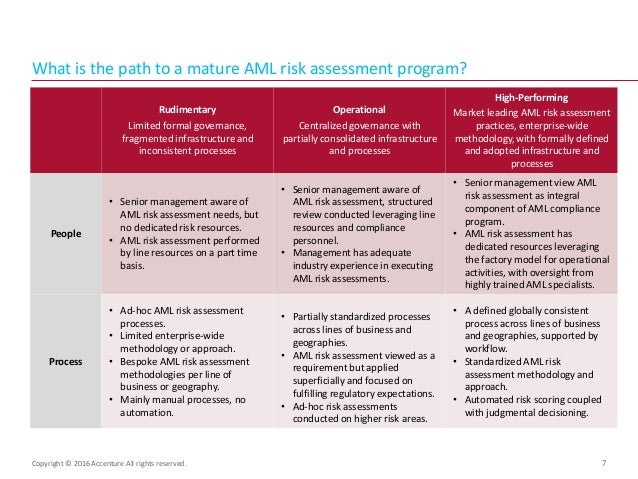

This course aims to describe and explain the Risk-Based Approach RBA procedures so that the firms focus their efforts on those areas where the risk of ML and TF appears to be higher. The first is the idea of geographic risk. Money laundering risks may be measured using various categories which may be modified by.

The second is the idea of individual risk the specific risks that financial institutions face from their clients and how their internal AML process manages that risk. This includes exposure to major sanctions and AML programs which may be in force. Residency or principal places of business incorporation citizenship origination destination of funds location of primary customers Status as or relationship with other high-risk individuals entities eg.

Each country is assigned a risk score a rank and high medium or low ratings based on money laundering and terrorist financing weight factors. There are circumstances where the risk of money laundering or terrorist financing is higher and enhanced CDD measures have to be taken. Geographic risk is an important component to leverage when assessing customer and transaction anti-money laundering AML risk.

National Money Laundering and Terrorist Financing Risk Assessment FATF Guidance 4 2013 1. Money laundering geographical risk suspicious transactions risk based approach rule based approach Abstract. Identifying Risk The filers enable risk identification through individual country risk selection or alternatively risk can be analysed at a global risk level identifying all countries in that risk category.

What is IBM Financial Crimes Geographic Risk Insight. Resources should be efficiently invested and applied where they are most required. Non-financial institution companies have unique anti-money laundering risk profiles.

Offshore transactions increase ML riskThe product and customer types of an offshore business increase ML FT riskGeography risk for place of incorporation and operations should also be examinedAMLCFT risks. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular. The EBA issued today a public consultation on revised money laundering and terrorist financing MLTF risk factors Guidelines as part of a broader communication on AMLCFT issues.

Risk Based Approach RBA to Anti Money Laundering. Money Laundering Risk Assessment Assessment of money laundering risk is important given that any bank would be exposed to considerably high level of such risk due to the inherent nature of banking operation. They should document those.

Identifying assessing and understanding risks is an essential part of the MLTF implementation and development of a national anti-money laundering countering the financing of. Money Laundering Prevention Act 2012 empowers BFIU sufficiently to establish a sound. Geo-financial risk is a term coined by Iain Stewart which relates to the level of geo-political risk in any riskreward paradigm which investors undertake.

The USD value locked in DeFi has grown exponentially in 2020 thus creating potential new money laundering risks. According to CoinGecko DeFi has locked up 37157 billion USDof Ethereums total market capitalization. It is then important that the anti-money laundering regimes are weak or in a highly corrupt jurisdiction.

The solution assesses risk and rates countries according to money laundering and terrorist financing risks. Border risks are important for interpreting real risks. In banking institutions those responsible to undertake risk assessment include the frontline officers who are dealing with customers.

The first thing that matters is that the propertys location matches the buyer and sellers location. Activities as an evaluating factor for determining country or geography risk may be appropriate Countries identified by credible sources as having significant levels.

Seven Sound Practices Understand The Quantity Of Money Laundering Risk At Your Organization Confirm That Policies Procedures And Controls Address All Ppt Video Online Download

Anti Money Laundering Aml Risk Assessment Process

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Anti Money Laundering And Counter Terrorism Financing

Financial Crime Risk Assessment Acams Today

Money Laundering Risk Assessment Aml Software

Anti Money Laundering Programmes Systems Financetrainingcourse Com

5 Ways Financial Institutions Are Improving Anti Money Laundering Measures Bfc Bulletins

Anti Money Laundering And Counter Terrorism Financing

Geographic Risk Data Data Derivatives

Risk Management In Us Msb Institutions Imtc

Line Of Business Aml Policies And Procedures Ppt Video Online Download

Anti Money Laundering Programmes Systems Financetrainingcourse Com

Anti Money Laundering And Counter Terrorism Financing

The world of rules can look like a bowl of alphabet soup at instances. US cash laundering laws are no exception. Now we have compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm centered on protecting monetary services by decreasing danger, fraud and losses. Now we have large financial institution expertise in operational and regulatory danger. We've got a robust background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adversarial consequences to the organization as a result of dangers it presents. It will increase the likelihood of main dangers and the opportunity cost of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment